Few fundamentals about Credit Score ( In USA )

There are three Credit Bureaus in US,

These credit bureaus receive credit-related information from companies that you do business with. They may also pull relevant public records, like tax lien or bankruptcy, and include that information in your credit report. The major credit bureaus only provide the information or other analytical tools to help businesses make decisions. The bureaus themselves do not make the decision.

NOTE: FICO Is Not a Credit Bureau

FICO, the company who developed and maintains the FICO credit score is not a credit bureau. While they compile your credit scorebased on data from the major credit bureaus, they do not collect credit report data on their own.

As per government regulation. All the three bureaus provides credit reports to every legal residents in US, on request. The credit report can be requested at https://www.annualcreditreport.com ( Note that you dont get credit score here, only report )

These days various banks provides free access to your credit score along with your credit card a/c. For example Bank Of America does.

You will notice a message there such as 'Your FICO® Score 8 based on TransUnion® '

This means, this score is one of the three FICO scores available from FICO. the following will give some idea on the various factors effecting your credit score.

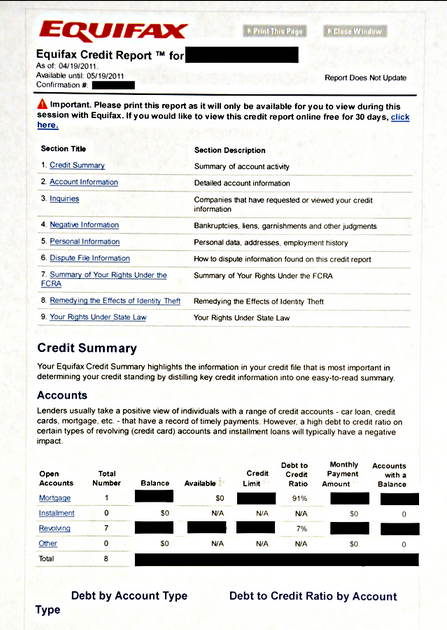

A credit report can be received from the the bureaus as well as from FICO and/or others. The bureau will specify the Score in the report. A sample Report from Equifax would look like this. Basically It contains all major information but not detailed history of each transaction reported by financial agencies.

Thats the third thing. Credit History.

I don't know any ways to retrieve a detailed credit history of all transactions that are reported by financial institutions, at this point of time.